It is an indisputable fact that one’s good luck in trading, whether intraday, swing, or F&O, is highly dependent on how much practice he or she has put into the process. Of course, experience is the REAL TEACHER in learning trading.

In my experience, it is not rocket science to learn the basic things about the stock market and trading, like the theories, functions, workings, and technicalities.

|

|

|

|

| Breakout Trading Made Easy | Price Action Trading | Options Handbook | Trading Chart Pattern |

| Sunil Gurjar | Sunil Gurjar | Mahesh Chandra Kaushik | Pramesh Universal India |

Even a novice with a minimal idea of the stock markets can self-learn those basic things with a decent effort over a few weeks or months, thanks to a large collection of freely available educational content that spans across the web in the form of blog posts, YouTube videos, webinars, and more. Yes, I talk from my own experience.

| Warning: I am not a professional trader or financial advisor of any kind. Only a retailer trader with a passion for writing and blogging. My writings on this blog and other connected platforms are meant for educational purposes only. Learn more here. Make sure you base your decisions solely on your convictions and studies. |

Truth: Practice is Ultimate

But when it comes to success in real trading, it is ultimately practice. If you start to learn trading with real money in the real market, things will most likely end up in a daunting situation of losing capital for most beginners, mainly in F&O and intraday.

That doesn’t mean swing or positional trading is safer for beginners. All trading requires practice and prolonged effort, apart from patience and good psychology.

Solution: Paper Trading is the Way

It is here that modern-day PAER TRADING PLATFORMS let you PRACTICE trading without putting a dent in your pocket, as well as in the same environments as in the real capital market, thanks to the highly sophisticated paper trading platforms and apps in India.

As you keep on studying the basics of the market and trading, you can simultaneously do virtual trading on any of the paper trading platforms and enjoy the experience of trading in a real market-like ambiance without risking a single buck.

Learn more about the fundamentals of paper trading in my article on How to Do Paper Trading in TradingView here.

There are many full-fledged web- and mobile-based solutions in India for paper trading. Not all paper trading platforms are free for users, or they have limited features in their free versions.

In this article on the best paper trading apps in India, I have my hands-on reviews of the best and most recommended platforms for paper trading.

1. Neostox Virtual Trading Platform

Pros

- Systematic and Advanced Paper Trading Platform.

- Both Desktop and Mobile Versions Available.

- Responsive Interface with Real-time Price Movements.

- Supports Futures and Options, Stocks, and Stock Options.

- Basket Orders and Pre-Built Options Strategies.

- Screeners, Webinars, and Other Study Materials.

Cons

- Pricier than the Alternatives.

Try Out Paper Trading on Neostox Here

Neostox Review

Neostox, in my view, is one of the most systematic paper trading platforms to trade in the Indian stock market, with both desktop and mobile versions available.

Its availability on a desktop is the coolest thing I love the most about Neostox, as long as it gives me increased convenience to read the chart clearly and punch trades in an environment that is exactly like real trading.

If you are a fan of trading on the phone, Neostox has an Android version but no iOS.

The Neostox platform is a professionally designed way to paper trade equities, futures, and options in the Indian stock market.

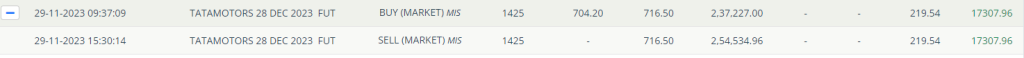

Screenshot: Tata Motors Futures trade on Neostox on November 29, 2023. Click here to see an enlarged version of the image.

Neostox is not free for serious traders, though. It costs a minimum of INR 250 per month to use the basic plan of the trading platform.

But you get more advanced features like basket orders, options strategies, screeners, advanced option charts, and open interest data in its more premium silver and gold plans only. They respectively cost 559 and Rs. 1,120 per month.

With more than 30 pre-designed options strategies, which cover almost all the popular options strategies out there, you can try and learn everything about trading without causing a dent in your pockets or bank account.

The basic plan offers you a virtual capital of 5 lacs for trading, and in the gold plan, you get unlimited funds for trading and unlimited trades per day.

Check out my complete hands-on review of the Neostox virtual trading platform here.

Though it is a dedicated paper trading platform, Neostox is indeed more than that.

With its top-tier premium plan, you get access to a wide range of market analysis tools like screeners, options strategies, basket orders, and other premium features that you can smartly integrate into your paper trading setups and get steady success in clearly understanding the basic concept of trading.

2. Niota Virtual Trading App

Pros

- Free Version with a Good Amount of Virtual Capital.

- A Very Responsive and Smooth Interface.

- Affordable Premium Plans with Extra Features.

- Real-time Data with Stop-loss and Target Options.

- Basket Order and Monthly Summaries.

- Nifty 50 and Bank Nifty Options.

Cons

- Data is Delayed for the Free Plan.

- No Stock Options Trading.

Try Out Paper Trading in Niota Here

Niota App Review

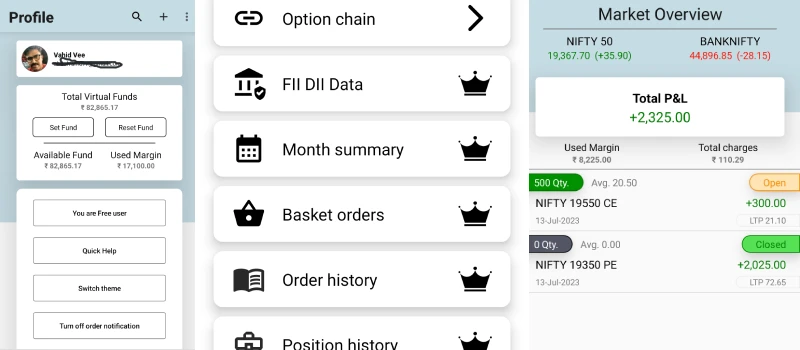

The Niota virtual trading app is the next choice in this collection of the top paper trading apps in India, and it is also one of my favorite picks for paper trading.

Niota is an impressive mobile application for practicing virtual trading in Nifty and Bank Nifty options with almost real-time price movements.

I have gone hands-on with the free and premium versions of the Niota app.

The free version of the virtual trading app is a bit slower at updating price changes. But in the premium version, which is much cheaper, you get more features like real-time price movements, option chains, basket orders, and monthly P&L summaries.

Niota features an easy-to-use and smooth interface that beginners can comfortably use to practice their trading skills in a real-world-like trading environment.

The premium plan at Niota costs only INR 49 per month and INR 499 per year.

You can create an account in the app simply by giving your details and making the payment for the premium version.

I made the payment for the premium through Google Play because there were no built-in payment gateways in the app as of this writing.

As I installed the app before the payment, I was required by the support team to uninstall it and reinstall it after the payment to get it running.

It is quite easy to take trades in the app, as it works exactly like a real trading app.

You can just choose a strike rate in the options chain and buy it quickly. The buying window has the facilities to set the stop-loss and target.

You can place the order at the market price or a limit price.

3. NSE Virtual Trading App 2.0

Pros

- Free for Beginners with a 50-Lakh Virtual Capital.

- A Responsive, Smooth, and Decent Interface.

- Affordable Premium Plans with Extra Features.

- Real-time Data with Stop-loss and Target Options.

- Nifty 50, Bank Nifty, and Stock Options Trading.

Cons

- Free Version with a Lot of Ads.

- Design Elements are Not Perfect.

Try Out Paper Trading on the NSE App Here

NSE Virtual Trading App Review

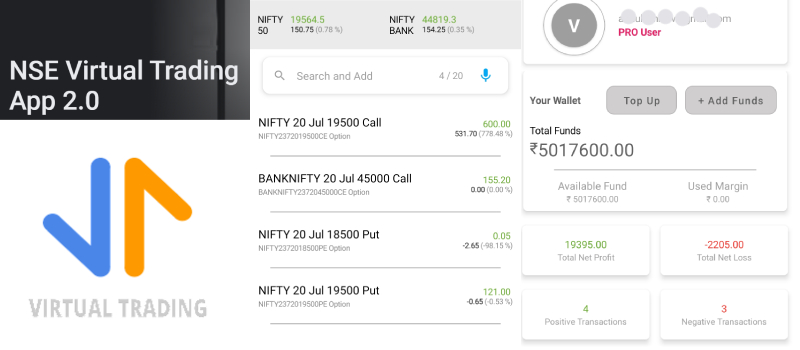

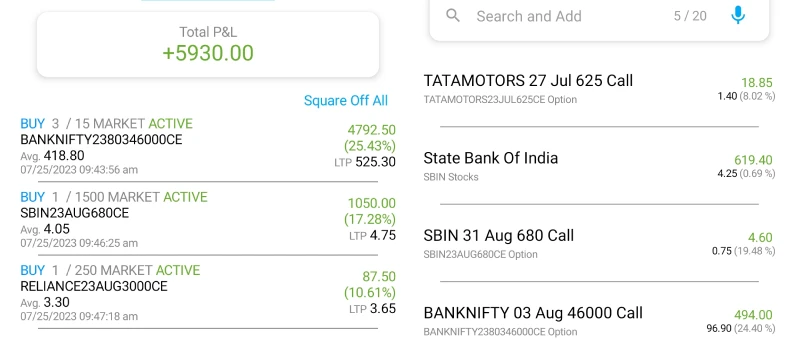

The NSE Virtual Trading App 2.0 is yet another top paper trading app I used for several weeks during the early stages of my trading practice. This app is good for trading F&O, including stock options.

It is a decent virtual trading app for beginners, even if it doesn’t have a wonderful interface, user-friendliness, or standard clarity of design elements, especially when compared to the Niota app.

This app is also available for free, but its premium gives you more advantages, like facilities for setting stop-losses and targets, more virtual money (up to 10 crores), and, of course, an advertisement-free interface.

The free version offers 50 lacs, and the ads appearing in between the screens can really test your patience. You will have to wait for the ads to finish to skip and see your positions and watchlists.

The premium version is cheap, like Niota. It also costs you only INR 50 a month and INR 500 a year. It doesn’t have an automatic payment gateway, which you need to make via a UPI ID and wait to get activated manually, it seems.

Overall, it is one of the coolest paper trading apps in India. It is only available as an app; you don’t have a desktop version.

4. TradingView Paper Trading

Pros

- Good Paper Trading Platform for Indian Equities.

- Completely Free for all TradingView Users.

- Simple, and Easy-to-Use Paper Trading Interface.

- Real-time Data with Stop-loss and Target Options.

Cons

- Not Suitable for Options in Indian Indexes.

- Virtual Credit and Trade Prices are Shown in Dollars.

Try Out Paper Trading on TradingView Here

TradingView Paper Trading Review

TradingView is a leading charting platform that offers real-time charts of all global trading instruments like stocks, indices, commodities, currencies, and more. Its stock screeners and other analysis tools, like heatmaps, are very popular among traders.

The TradingView platform accommodates a paper trading facility.

Well, TradingView paper trading is famous, and it is for trading equities and futures, not options. That is, you can paper trade the stocks in the Indian market right from the charts on the TradingView platform.

This is completely free for anyone who signs up for an account on TradingView, which offers multiple premium plans for advanced traders and investors.

I have taken a detailed look at how to do paper trading in TradingView here.

You can easily activate the paper trading feature on TradingView. Under a particular chart in the Supercharts, you can see the Paper Trading option, which you can enable by simply picking Paper Trading by TrawingView.

That is all.

You can now place paper trades right from the charts of equities on the Indian market. You can set stop-loss and target prices and place orders for market prices, limit prices, and more.

5. Sensibull Virtual Trade

Pros

- Virtual Trading Facility for Futures and Options

- The Best Platform for Options Strategies

- Easy Transfer of Strategies to the Virtual Platform

- A One-Stop Options Trading Solution for Retailers

Cons

- No Free Paper Trading Available.

- The Price Movements are Not Dynamic.

- Not a Great User Interface.

Try Out Paper Trading on Sensibull Here

Sensibull Virtual Trading Review

As you might know, Sensibull is a famous options strategy platform for retail traders in India. Though basically an options strategy platform, Sensibull is more than that, as it accommodates a wide range of other tools and features that help traders further delve into the nuances of trading in futures and options.

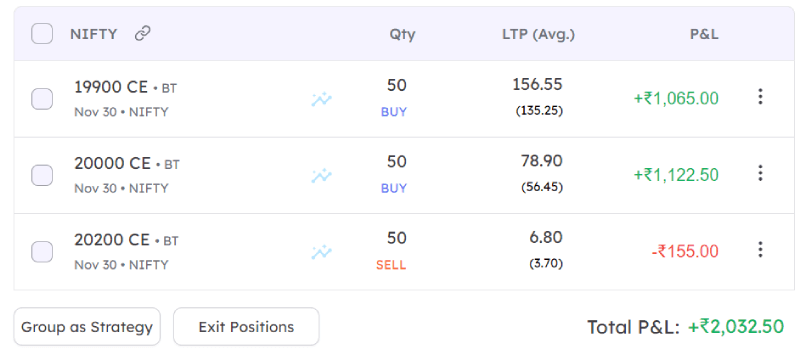

Sensibull features a cool paper trading facility for index options like Nifty 50 and Bank Nifty. The best part is that you can manage it on a desktop, as the facility is accessible on its website.

Moreover, you can easily transfer the option strategies that you either picked or built on Sensibull’s strategy wizard to the virtual trading platform with a single click.

That said, you don’t need to enter each strike manually, as it works exactly like you can place real orders directly from Sensibull on your broker’s terminal, as the platform supports all the leading brokers in India.

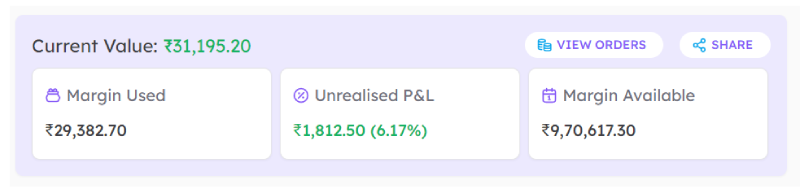

Screenshot: A sample bear buttery fly strategy is running on Sensibull’s virtual platform.

This is a fully premium feature that can only be accessed by paying a minimum of over INR 700, but at times you can also access the feature for free if you sign into the platform via your broker.

But, to be frank, I am not a great fan of this paper trading platform, which is mainly because Sensibull paper trading is not as responsive as some other platforms like Neostox and app alternatives, and what’s more, it is not very user-friendly as it has a sluggish and mediocre interface.

After entering into a trade, you will most likely have to keep refreshing the web browser for the changes in premium rates to reflect in your trades.

Once contacted by us, the team at Sensibull said it was designed in such a way as to meet the SEBI guidelines to prevent Dabba trading.

However, I was not very comfortable with paper trading on Sensibull, so I gave it up after testing it for a couple of days. The best thing is that they offer a complete refund of the subscription fee for seven days after the purchase.

Compared to the app alternatives, the Sensibull paper trading platform is unique in that you can use it to set up various trading strategies and test them in the virtual world before trying your hand in the ‘simmering water’ of the real market.

But sadly, things run slower there.

The claim of a one-minute delay in the price changes following the SEBI guidelines is digestible, but it is really unfortunate not to see dynamic price movements as the market runs.

6. Trinkerr Virtual Trading

Pros

- Simple and Easy-to-Use Virtual Trading Platform

- The Best For Learning Options Strategies

- Highly Responsive and Super Smooth Interface.

- INR 10L Virtual Capital for F&O Traders.

- Sync with Up to 14 Brokers for Equities.

Cons

- No Stock Options Trades.

- No Futures (Indices and Stocks)

Check Out the Trinkker Paper Trading Platform Here

Trinkerr Hands-on Review

Trinkerr is a highly user-friendly social virtual trading platform that is available on both the web and mobile. Trinkerr is good for trading index options, learning and executing options strategies, and sharing your thoughts with other traders on its platform.

Well, if you are looking to learn trading options and simply practice the strategies, Trinkerr is a good choice. It supports options trading in all the leading indices like the Nifty 50, Bank Nifty, Finnifty, Sensex, and Midcap Nifty as of this writing.

Unlike Neostox and some other paper trading platforms, Trinkerr has no complex setups. It is very easy for you to manage your virtual trades in options, but unfortunately, it doesn’t support trades in futures and stock options.

In my view, Trinkerr is indeed one of the best paper platforms out there for testing option strategies, and different from Sensibull, its easy interface and better usability make it a breeze for a beginner trader to learn and trade complex strategies.

You can just open the option chain of a particular index and choose the required strikes, or you can execute the ready-made strategies to see how these things turn out.

Moreover, along with being a paper trading platform for options traders, Trinkerr is a good choice for investors to track and monitor the live markets and plan their investments in stocks and other securities.

Trinkker supports around 14 leading brokers in India, so you can directly buy stocks from its platform on your real terminal and manage your portfolio with a more flexible interface on the platform.

Trinkerr is a relatively new paper trading platform in India, as of this writing.

I feel that it will get more improvements in features and capabilities quite soon. I will keep a check on its developments and update you here or on another page for an exclusive hands-on review of the platform.

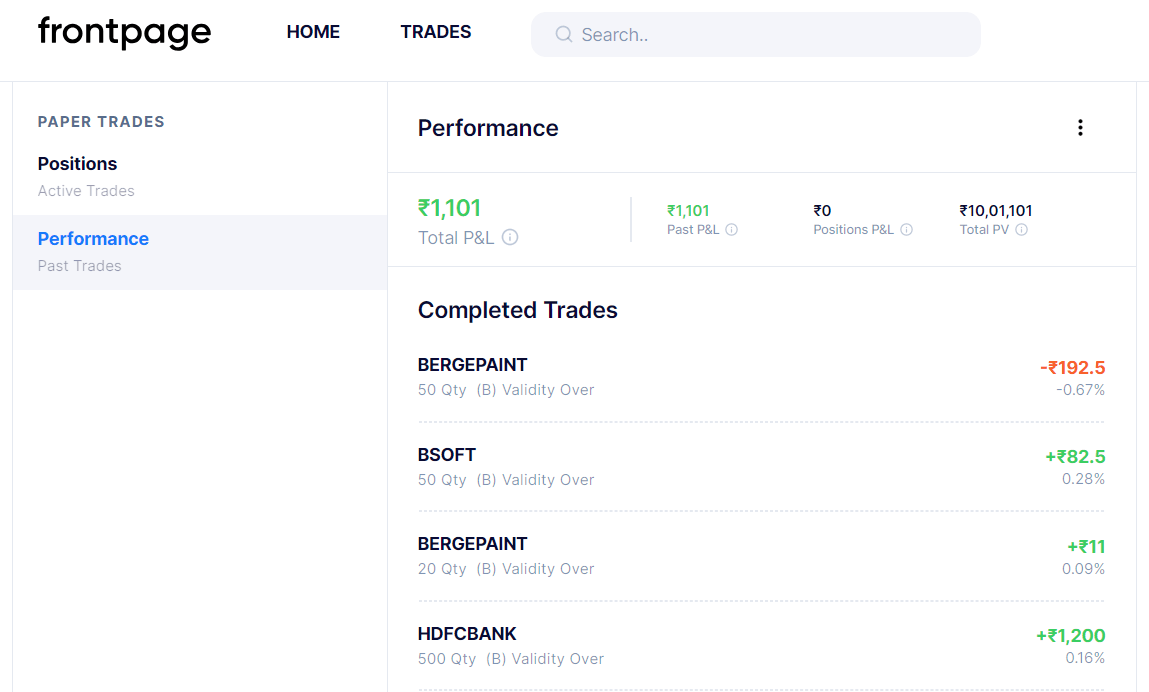

7. FrontPage App

FrontPage is actually a community-focused virtual trading platform where you can paper trade equities in the Indian stock market and publicly share your trades and experiences with other members of the community.

Well, unlike the other trading platforms, FrontPage features a unique idea of socializing, as you can maintain your profile with posts, images, and memes on your trades, market news, and other factors regarding the stock, commodity, and currency markets.

I don’t feel very excited about FrontPage as a paper trading platform, but it works super well as a community. However, the interface of the whole platform is still not attractive to me, and the communities over there are not very active, either.

FrontPage has both desktop and mobile versions.

Paper Trading Advantages

- It secures your money while you learn. You can trade with real-world experience, but not at the cost of your real money.

- It is a risk-free trading method. Even if you trade the same strikes and stocks, you can enjoy a risk-free trading experience.

- You get huge and unlimited virtual capital to trade. You don’t need to worry about breaking the bank, even if you’re aggressive in trading.

- It is a game-like experience to get into paper trading. You can just play a trading game on your mobile phone and learn how trading works, by the way.

Paper Trading Disadvantages

- Since there is no real money involved, there is no emotion involved in the process. Better emotion management is a key to success in trading. So paper trading does not give you that experience, which you will need to tackle in real trading later.

- Most paper trading apps and platforms offer the best of their services for payment.

Methodology

I have prepared this list of the best paper trading apps in India after testing all the leading and well-known products of their kind over there. I have only added the ones that I find worth a look at to this list to make it a better and more reliable list for beginner traders.

I have gone hands-on with all the platforms by subscribing to their premium plans and testing them for at least one month with the different types of trades they let you do. It would give me a lot of chances to review every feature of the platform by trading in the real market along with my real trades.

Since I am not an advocate of aggressive intraday trading, I get a lot of free time to test these paper trading and other trading and investment-related tools and platforms in the live market and give you the best inputs through my articles, reviews, and blog posts.

By the way, if you think I have missed out on adding some items to my list, you can contact me here to suggest an entry for the list. I will test it and add it to the list if I find that it is useful for a trader to enjoy paper trading.

Frequently Asked Questions

Is Virtual Trading Free on Sensibull?

No, it is not.

You need to pay a minimum of INR 700 to use the virtual trading facility on Sensibull.

That is, you need to buy the Lite plan on the platform, which also gives you access to a lot of premium features like EasyOptions, Data Tools, Strategy Wizard, Basket Orders, FII DII Data, Options Price Calculator, and more.

Update: As of writing this update in November 2023, complete access to Sensibull, including the virtual trading platform, is free for users who log in to Sensibull through a broker like Zerodha, Angel One, and more. I don’t know if this feature will be available for longer, and it may change when you check back later.

Is Paper Trading Free in TradingView?

Yes, it is. Paper trading in TradingView is completely free.

However, the facility is not available for trading options in both indices and stocks in the Indian market. You can only practice by buying and selling equities and futures on TradingView in India.

Is Paper Trading Available in Groww?

No, paper trading is not available on Groww, one of the leading trading apps in India. Groww is a highly beginner-friendly trading app or platform, thanks to its easy-to-use and simple interface.

Is There Any Risk in Paper Trading?

No, there is no risk in paper trading, which is why it is called paper or virtual trading.

It is a simple way to effectively learn how trading works in securities, stocks, and derivatives without losing real money.

As you do the trading with the freely available virtual capital, you lose nothing, but you will be able to learn the basic structures of trading in a simple and risk-free way.

The Sum Up

That is my list of the best virtual trading apps and platforms in India. These are the most commonly used platforms for virtual trading by beginner traders.

We also have many advanced stock market simulators, games, and other platforms that help you paper trade and make trading an easy experience without risking your money. Some of the examples are Stockpe, Dalal Street, TradingLeagues, etc.

The Main Image by Starline on Freepik

Vahid Vee is, by profession, a blogger and search marketer, and by passion, a stock investor and trader who loves to write on various ready-to-go platforms and systems that help people make good decisions in trading and investing. As an investor and trader on F&O, swing, and long-term positions in the Indian stock market, he is excited to share with you his experiences over at TradeTranz here. #Contact him @ vahidvee@tradetranz.in – LinkedIn – Quora – Reddit

Your exploration of the significance of paper trading and the top paper trading apps and platforms in India is incredibly informative. It provides a clear understanding of the benefits and the tools available for those looking to refine their trading skills. Thanks for sharing this insightful and practical guide!