Naked buying or selling options (puts or calls) can be an easy task for anybody. Even a beginner in the stock market can easily place orders for buying and selling options, but the profitability aspect of naked trades is a different story, as it hinges on many factors like trading skills, risk appetite, and risk management, and that is not my topic here.

What I want to stress here is that the process is not that easy when it comes to placing a hedged position of any kind, either in options, futures, or stock options.

|

|

|

|

| Breakout Trading Made Easy | Price Action Trading | Options Handbook | Trading Chart Pattern |

| Sunil Gurjar | Sunil Gurjar | Mahesh Chandra Kaushik | Pramesh Universal India |

The reality is that only an experienced hand can carefully design the baskets of hedged positions and, in case of any unexpected and volatile turns in prices, adjust the legs to make sure your trade culminates either in profit or without a big capital washout.

| Warning: I am not a professional trader or financial advisor of any kind. Only a retailer trader with a passion for writing and blogging. My writings on this blog and other connected platforms are meant for educational purposes only. Learn more here. Make sure you base your decisions solely on your convictions and studies. |

So the question is, how can a newcomer take hedged positions in options confidently? Here, you can simply rely on options trading platforms like Sensibull and Opstra, which amazingly help beginners analyze, backtest, and take positions with no trouble.

Sensibull Vs. Opstra: At a Glance for Busy Go-Getters

Sensibull Key Points

My View: The Best for Option Strategy, Paper Trading, and Direct Trades Opstra Key Points

My View: The Best for Backtesting, Simulation, and Information |

As an options trader for a couple of years and a regular user of these two platforms, especially Sensibull, I would like to get you the famous strategy builders, which also come with an awesome range of other helpful tools like backtesting tools, options chains, open interest, options simulators, virtual trading platforms, and more.

Stay tuned to have a detailed look at my comparison of the platforms here at Sensibull vs. Opstra, which I think will be quite helpful for you to deeply dive into everything you need to know about the platforms and design your options strategies with confidence.

Methodology

For this article, I have chosen two of the popular options strategy platforms in India. Being a long-time user of these platforms for my research about options trading strategies in the stock market as well as my own real-life experience with trading, I have compared these two platforms on my blog.

I have had a detailed look at all the key features of the platforms and tried to include all the important elements in this article. The article purely expresses my view on the features, systems, and usability of the options strategy platforms.

What is Sensibull and How Does It Work?

Sensibull is a leading options trading platform for traders in India, with a lot of regular users from the communities of both rookie and experienced traders.

The main attraction of the platform is that it enables even a beginner to trade option strategies without a deep knowledge of how these strategies work out.

You can simply choose any of the pre-designed option strategies listed over there and analyze them in various easy-to-understand payoff graphs, tables, and more before placing the trades with them in the real market.

If you are an experienced trader, you can also design your own strategies on the system’s strategy builder and study them in detail in various formats, including graphical representations, to clearly understand how they work.

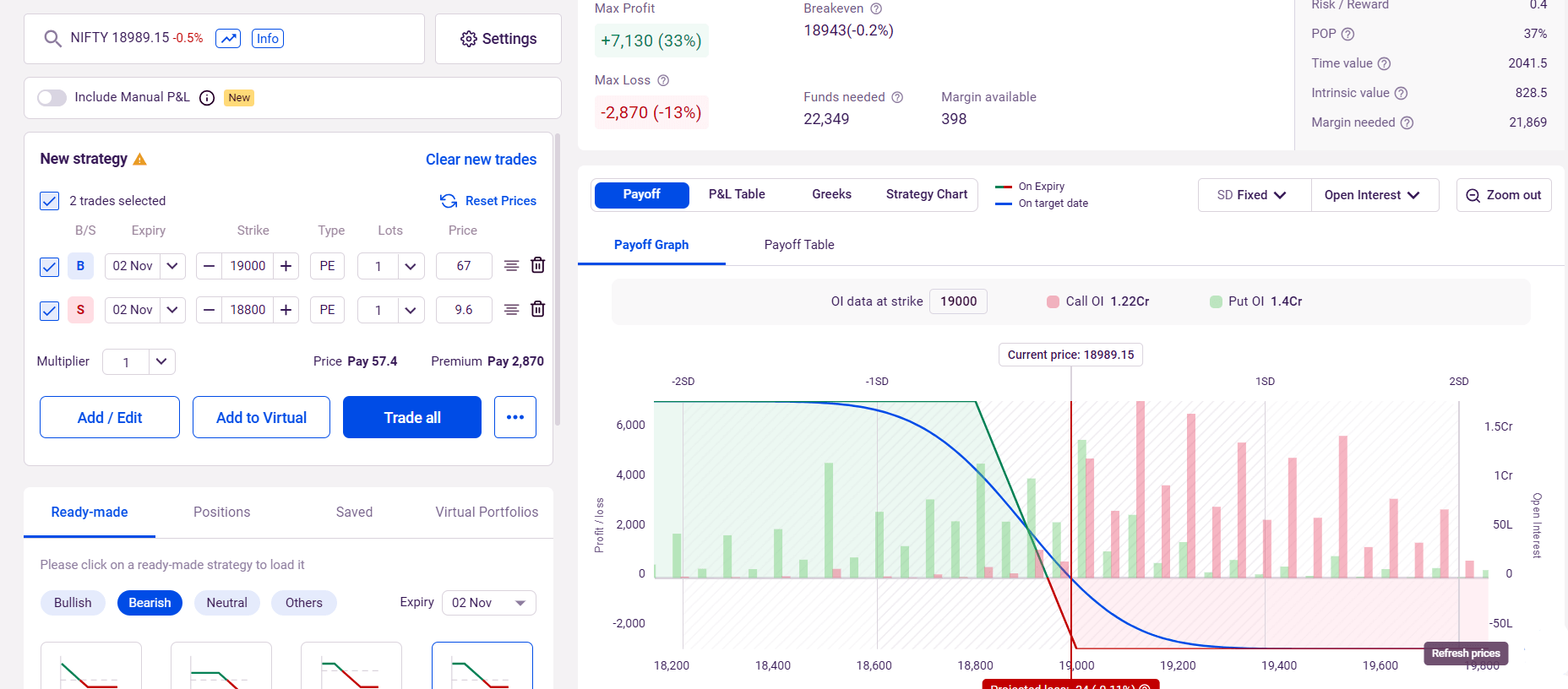

Screenshot: A sample view of a pre-designed bear put spread strategy on Senisbull in the Nifty 50 in a market with bearish sentiment: It was grabbed on November 1, 2023.

Though Sensibull is fundamentally an options strategy platform, it is more than that.

Along with hosting one of the best options strategy builders of its kind over there, it also features a wide range of other useful tools for traders, like a virtual trading facility, which you can simply use to test the options strategies that you have selected or built on Sensibull before trying them in the real market.

Furthermore, Sensibull offers options chain data, open interest data, FII DII data, live options charts, screeners, technical signals, IV charts, and many other important market analysis tools that can further enhance your confidence to stay strong in the market.

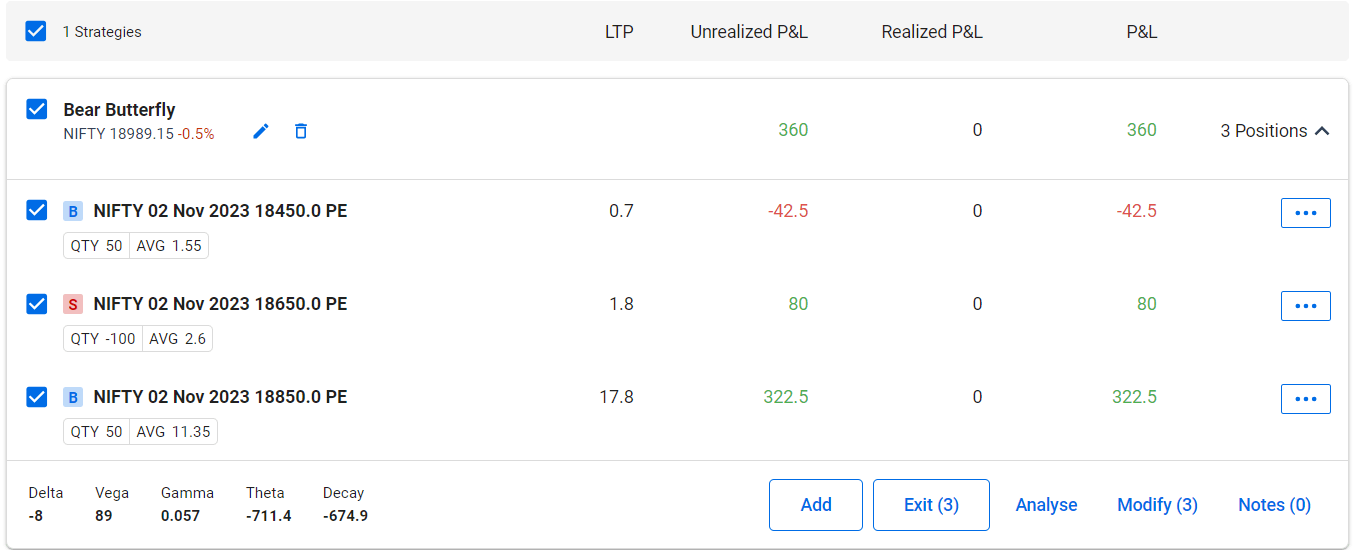

Screenshot: A sample bear butterfly strategy on Senisbull’s virtual trading platform ahead of a Nifty 50 expiry day on November 1, 2023.

Above all, Sensibull lets you directly execute trades on your broker’s terminal.

That means you can focus on setting up your options strategies in Sensibull’s in-house strategy builder and simply launch the trade on your broker’s terminal with a click of a button.

If you are a beginner, you can do the same on the platform’s built-in virtual trading terminal for studying, by the way. Sensibull is in partnerships with some of the leading brokers in India, which are Zerodha, Angel One, Upstox, ICICI Direct, 5Paisa, and IIFL, as of this writing.

More interestingly, if you are a user of Zerodha and Angle One, you get completely free access to Sensibull’s premium features. Learn more from the words of Abid Hussain, the co-founder and CEO of Sensibull.

What is Opstra and How Does It Work?

If you are thinking about an alternative to Sensibull, there seems to be no other good choice than Opstra Definedge. Though I am not a big fan of Opstra, maybe because of my love for the former as a long-time user of it and some usability reasons, Opstra doesn’t look anything bad, and it has thousands of active users.

Opstra is also basically an options strategy platform, but it highlights some more features and tools that can give you a more in-depth outlook of the market, both futures and options, as well as an impressive options backtesting tool, as the main attractions, in my view.

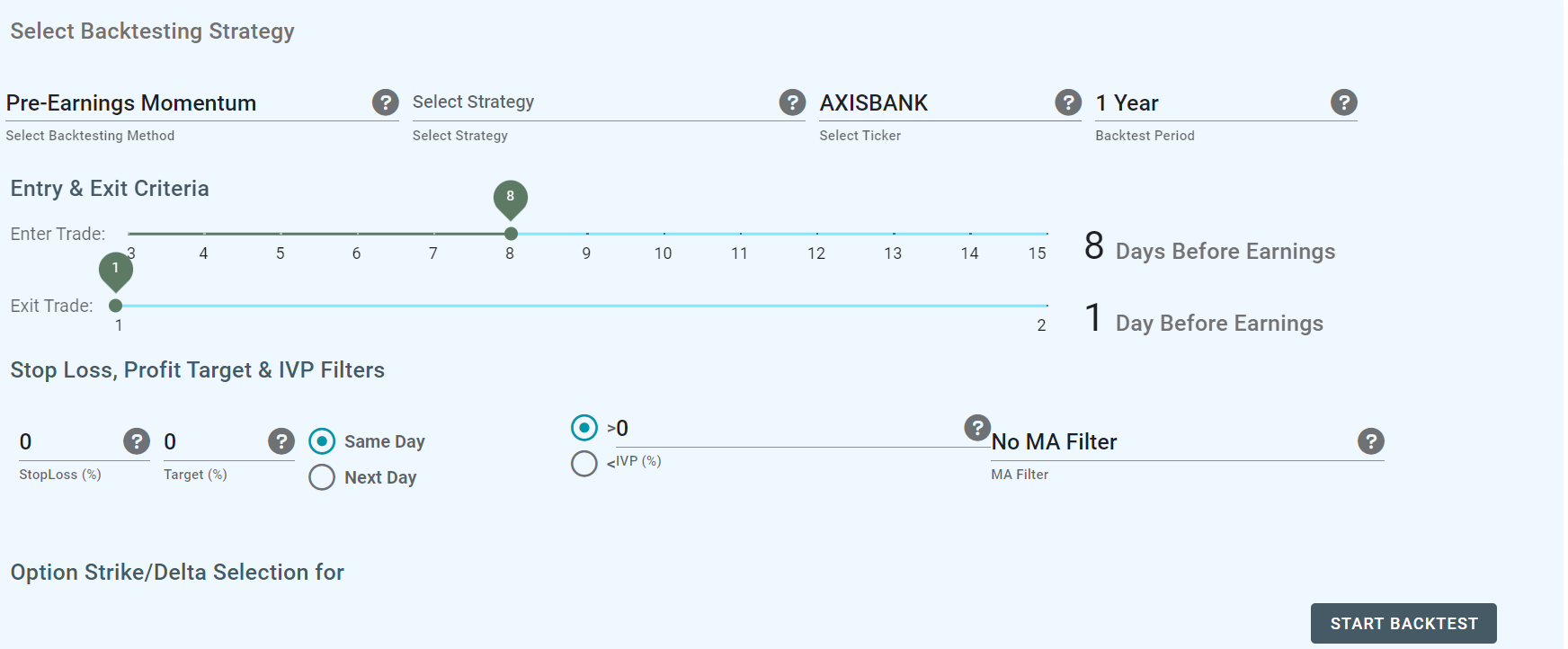

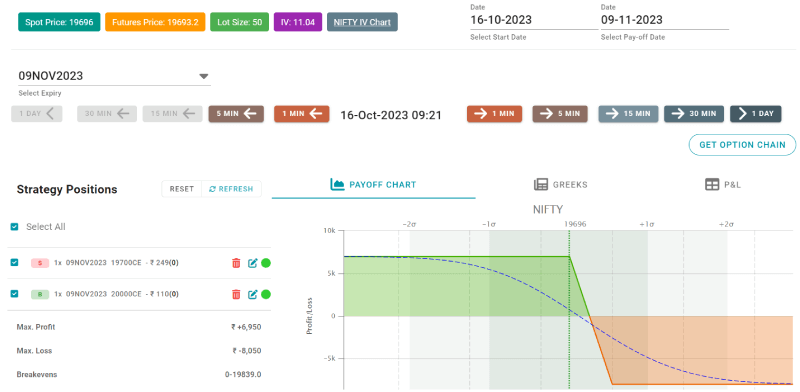

Screenshot: Opstra Options Backtesting Tool.

A confusing thing about Opstra is that it has two versions on the web. The regular one is merely an options strategy platform that doesn’t have the same facility for placing direct trades with a broker as it does with Sensibull, which is often considered a shortfall of the platform.

But the other version has a different URL, which you can access from your Definedge dashboard, and it has the facility to transfer your strategies as trades to the terminal of Definedge in a simple step. You can also watch your portfolio and track your orders on the Opstra interface, but direct trading is only available on the Definedge terminal, as you can see.

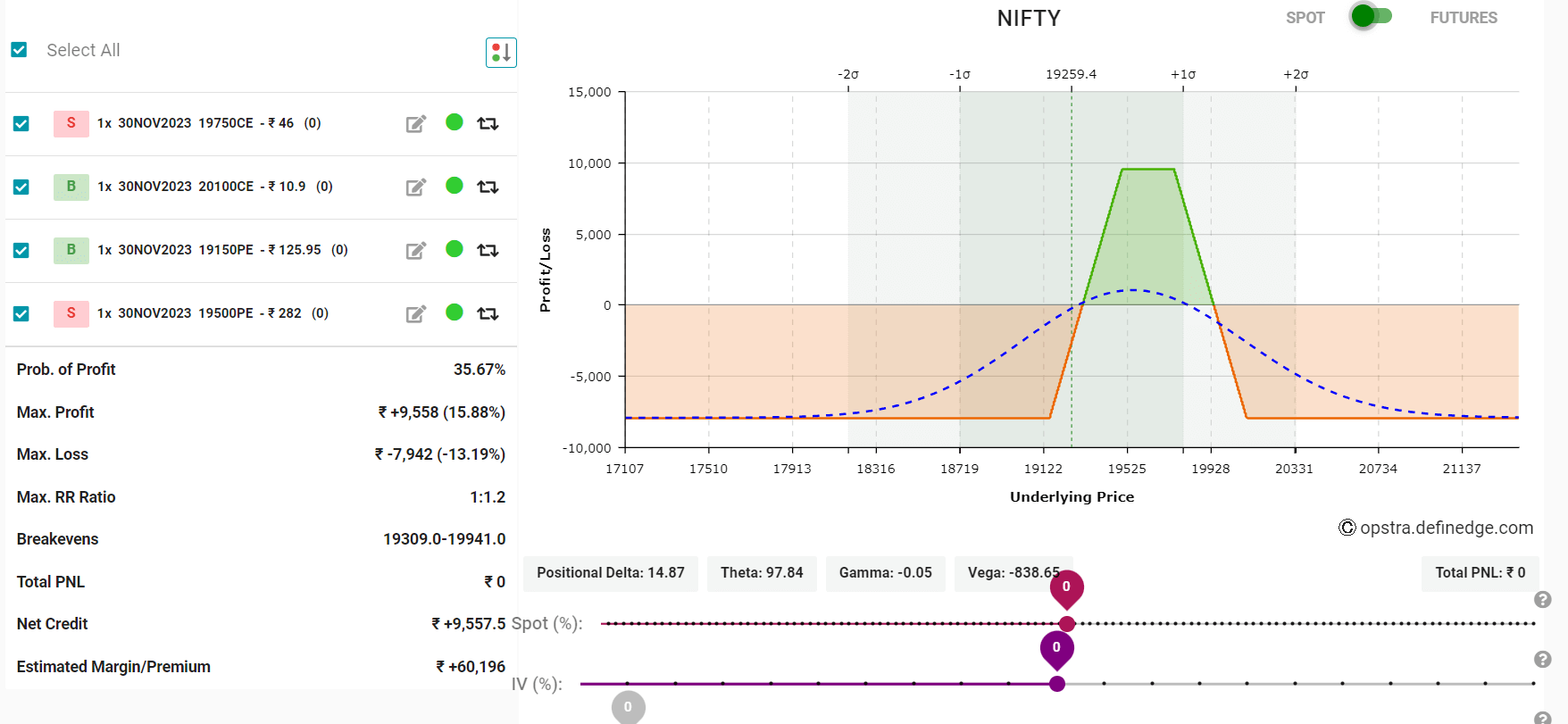

Screenshot: A sample bullish condor strategy on Opstra’s options strategy builder, recorded on November 3, 2023.

Apart from the direct trading facility, the Definedge Opstra variant also has a paper trading facility. You can choose any of the pre-designed options strategies on Opstra’s strategy builder or custom-design your own strategies and execute them on the included paper trading facility before trying them in the real market.

Of course, as it is with Sensibull, you can choose from a wide range of pre-designed strategies to design your own strategies for futures and options on Opstra and watch how they work in the real market in graphical representations like payoff tables, graphs, and more.

The Definedge variant of Opstra is freely available to the broker’s customers for a month, and it costs around Rs. 700 per month after the trial period.

Sensibull Vs. Opstra – The Differences

Systems and Strategies

Both Sensibull and Opstra are famous options strategy platforms with a wide range of impressive systems and solutions to help you understand and learn complex strategies and data sets in the futures and options markets of indices and individual stocks.

When it comes to strategy builders specifically on both platforms, I feel that Sensibull has a clear upper hand over Opstra with its highly user-friendly options strategy builder and strategy wizard.

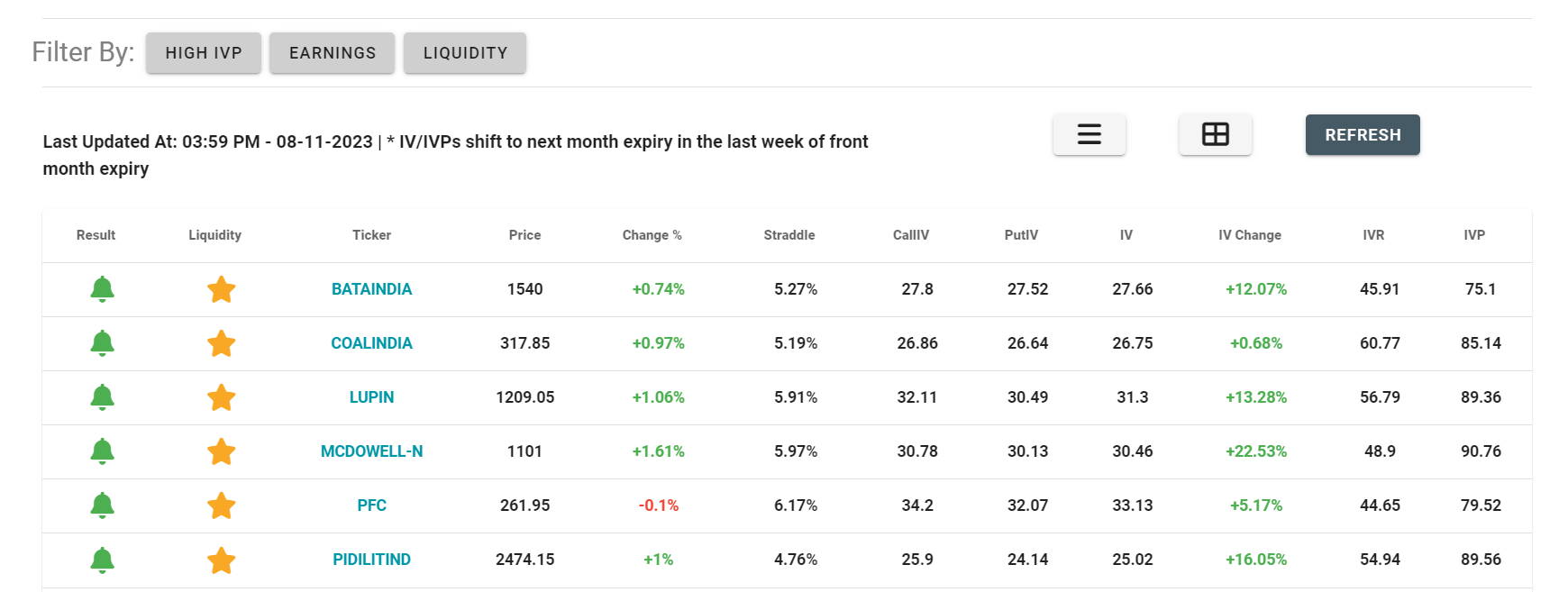

Screenshot: A View of the Opstra Options Dashboard on November 8, 2023

Opstra also features an advanced options strategy builder, but that, in my view, is not as user-friendly as the one on Sensibull because you can easily modify and make changes to the strike legs, expiry dates, and other inputs on the latter’s strategy builder.

To be frank, I enjoy testing my options strategies on Sensibull, not Opstra, because of its rather comfortable interface and ease of modifying a strategy in a test. You can just press the + button to change the strike price, and you can simply change the expiry date in the same window and apply the changes immediately to the graphs.

More or less, that may not be a big deal for everyone, and maybe it is my personal bias, but the overall interface of Sensibull is way better than what Opstra has.

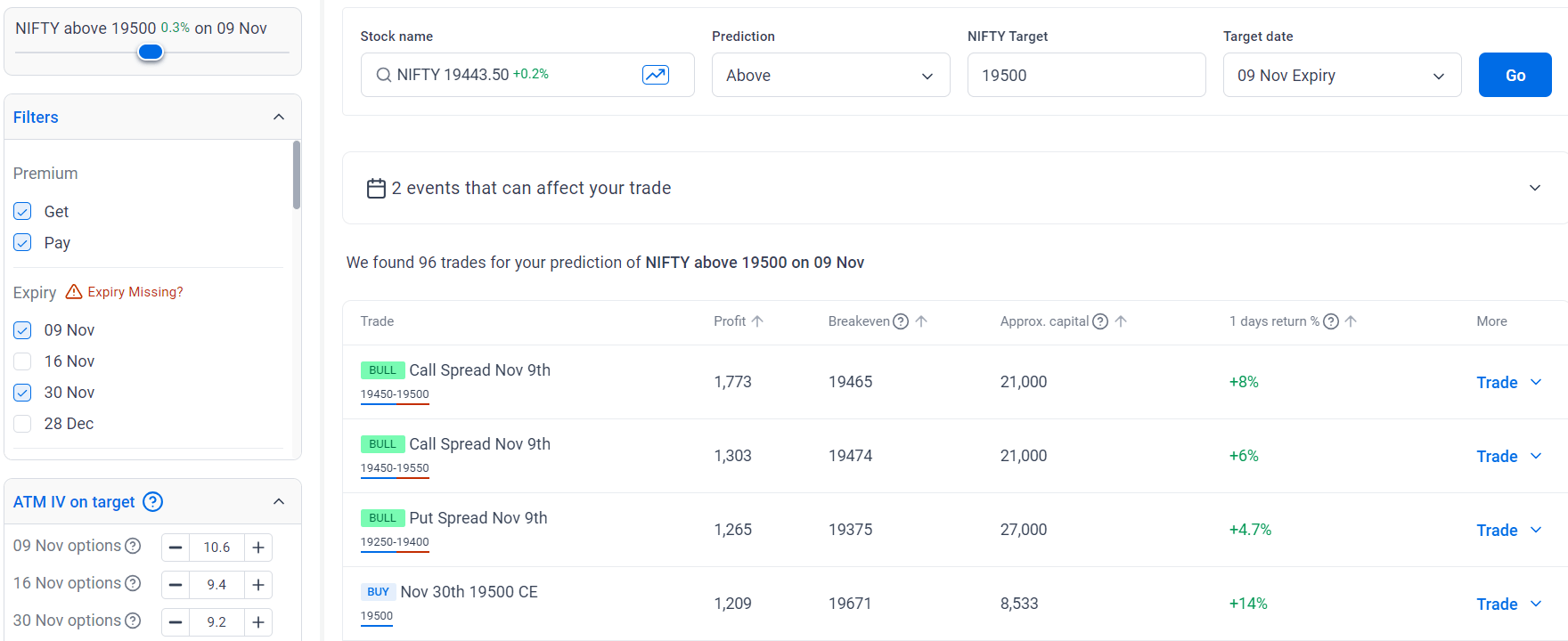

Screenshot: A View of the Sensibull Options Strategy Wizard.

At the same time, Opstra is good when it comes to backtesting and simulation tools.

A cutting-edge backtesting tool for options is really worth mentioning, and there is no way you can backtest option strategies on Sensibull.

Added to the backtesting tool, a state-of-the-art option simulation tool is another key highlight of Opstra. This lets you hand-pick each strike you want to test in your options strategies and simulate payoff tables, P&L, and other options elements in a clear way.

Of course, these two tools for backtesting and simulation give Opstra a clear edge over Sensibull. These tools have a lot of followers among traders in India.

Screenshot: A View of the Opstra Options Simulator.

In addition, compared to Sensibull, Opstra offers a lot of information-rich scanners for you to relieve your stress in the live market and design more profitable trades. All the important market data, like open interest, OI charts, PCR, futures and options buildups, volatility skew charts, and historical charts, are all under one roof.

Opstra’s Options Algorithm strategy designer is also a brilliant tool. You can simply input the tool with your view (prediction) of the market – both indices and individual stocks – and let the system find the best strategy for you to work on. This feature is also available in Sensibull under the name Strategy Wizard.

Price and Plans

You only get premium features on both Sensibull and Opstra, which include real-time updates, options strategy builders, and a lot of other vital market data, on their paid plans. Free plans have limited access and delayed data.

The monthly price of Opstra is Rs. 1300 on its regular version, while the Definedge variant has a monthly price of around Rs. 700, but for that, you need to have a Definedge trading account. Also, as said above, Definedge users get free access to Opstra for a month.

When it comes to Sensibull, the platform has two plans: Lite and Pro, respectively priced at Rs 590 and Rs 800 per month. But if you have a trading account on Zerodha and Angle One, you can freely access the platform and enjoy the whole range of premium features forever.

The Web Traffic and Popularity

We have already had a detailed look at all the key features, like interface, usability, and systems, of both platforms. In this portion of the comparison, I would like to explore the popularity and traffic of the options trading platforms on the web in India.

So you can see which one is the most popular among netizens. I rely on the data from Google Trends and SimilarWeb to analyze the traffic and popularity of Opstra and Sensibull, and this data was recorded in November 2023. It might change when you check back later.

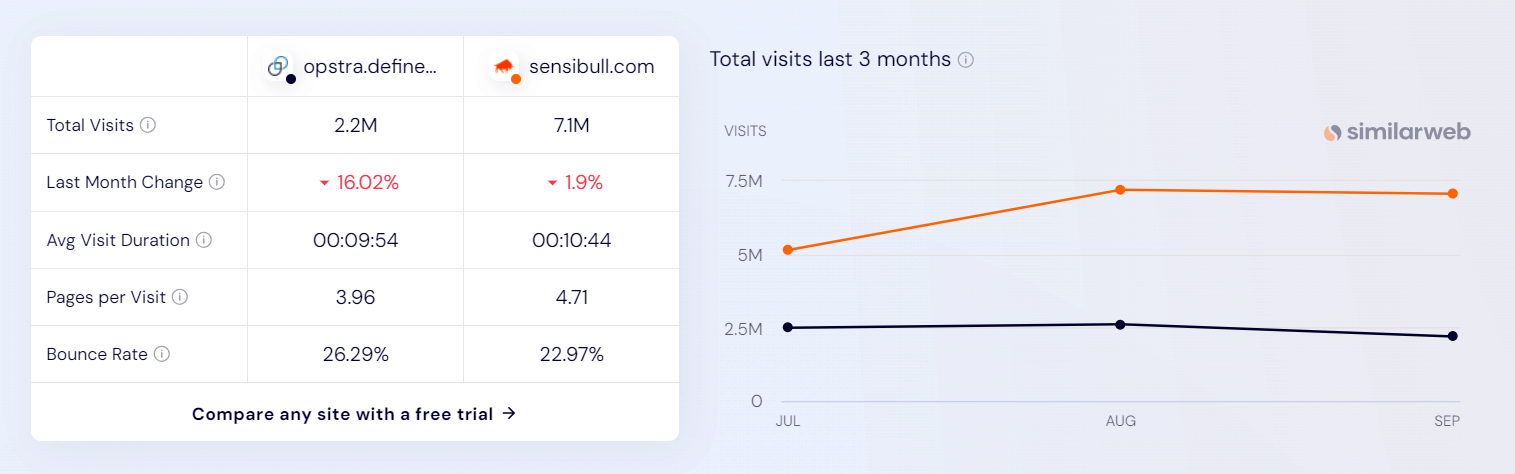

Traffic and Engagement

In my scanning on Similarweb, Sensibull has a total visit count of more than 7 million, a page per visit of 4.71, and an average visit duration of 10+ minutes. At the same time, Opstra has a lower edge here, as it has only 2.2 million total visits with a page per visit of 3.96 and an average visitor stay time of 9.50 minutes as of the September 2023 data.

Screenshot: The three-month traffic comparison of Sensibull and Opstra on SimilarWeb as of September 2023. The figures may change when you check back sometime later.

Interest Over Time

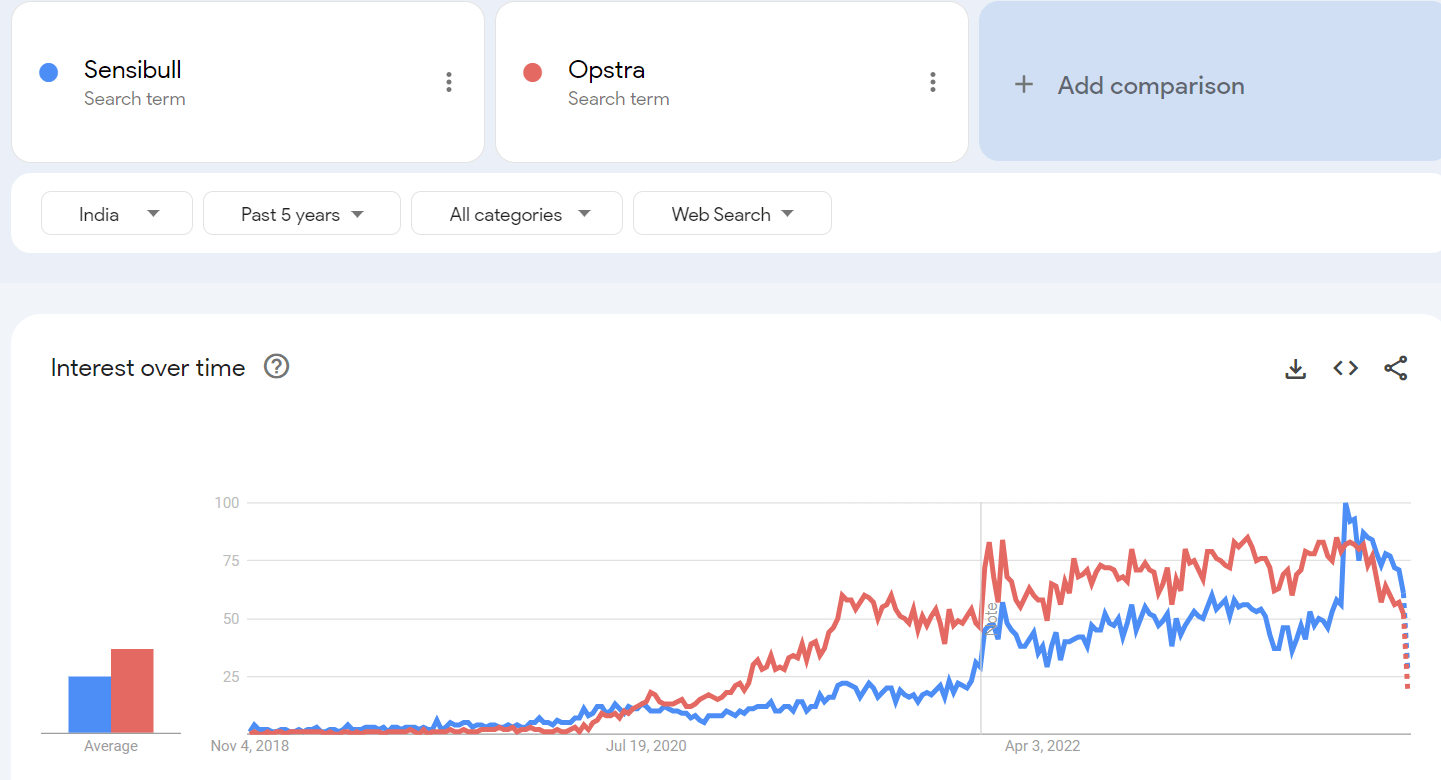

Below is the Google Trends data that compares the keywords of Sensibull and Opstra for the last five years in India. As you can see, both platforms have been showing gradual growth in search interest since their launch around five years ago.

The data interestingly shows a spike in interest by the beginning of 2022, maybe caused by the post-Covid boom in intraday trading among younger people across the world.

Anyway, Opstra has had a clear upper hand over Sensibull for years, until the middle of 2023. Since then, a slight fall in interest in Opstra has been visible, and evidently, there is a clear spike in the Sensibull data at the same time.

Frequently Asked Questions (FAQ)

Is Opstra Definedge Better than Sensibull?

Though it largely depends on your user experience, I will say that Opstra is better for backtesting and option simulation. But I don’t recommend Opstra over Sensibull when it comes to usability, interface, and even the options strategy builder.

Can I Use Sensibull’s Strategy Builder for Free?

The advanced features of Sensibull are only accessible in the premium version, but if you have trading accounts in Zerodha and Angle One, you can access Sensibull for free and enjoy all its advanced features with no limitations.

Can I Trade Directly from Senisbull?

Yes, you can directly place trades on your trading terminal right from Senisbull if you have signed into the platform via your broker’s account details. Sensibull supports all the leading digital brokers, like Zerodha, Angel One, Upstox, 5Paisa, and more.

What Are the Main Advantages of Sensibull?

Sensibull is a powerful options strategy platform with an award-winning strategy builder, a virtual trading platform, a direct platform-to-broker trade feature, and a wide range of updated screeners and analysis tools for reading options chains, open interest, and more.

Furthermore, you can test your options strategies, monitor the potential outcomes with clear graphical and payoff tables, and make your trades more profitable and confident.

Does Sensibull Have Backtesting Tool?

No, when compared to Opstra, Sensibull doesn’t accommodate a backtesting tool as well as an option simulator facility. But you can use the platform to design your strategies and test them perfectly with easy-to-understand payoff tables, graphic representations, option greeks, and more.

Is There an Options Simulator in Sensibull?

No, in contrast to Opstra, Sensibull doesn’t have a perfect simulation tool that you can use to backtest your option strategies on a previous period to see how they would work as per the market movements of that time.

In place of that, Sensibull highlights a cutting-edge paper trading platform that you can use to test how your strategies will turn out in future markets.

Can I Use Optra for Free of Cost?

Yes, but not premium features like option backtesting and simulation tools. Only paid users can access these advanced features and updated data to support their trades. Opstra is freely available for a month for the users of the Definedge broker, however.

Is Opstra’s Backtesting Tool Free?

No, you need to be a premium member of the platform to use its backtesting tool. Free users are not allowed, but if you want a trial of it for a month, you can try it by opening a trading account on Definedge Securities.

Vahid Vee is, by profession, a blogger and search marketer, and by passion, a stock investor and trader who loves to write on various ready-to-go platforms and systems that help people make good decisions in trading and investing. As an investor and trader on F&O, swing, and long-term positions in the Indian stock market, he is excited to share with you his experiences over at TradeTranz here. #Contact him @ vahidvee@tradetranz.in – LinkedIn – Quora – Reddit